Whales That Traded the $USDC Depeg

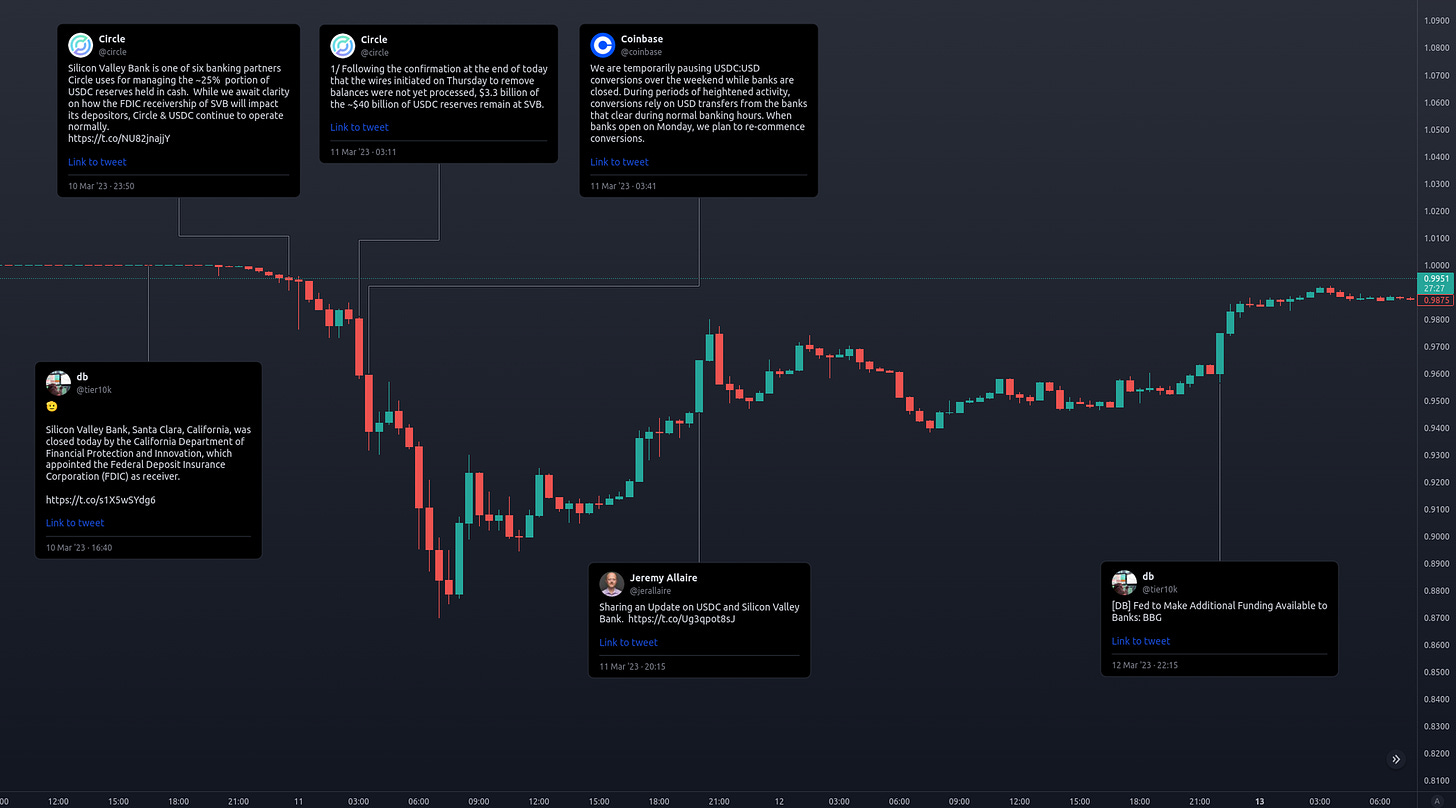

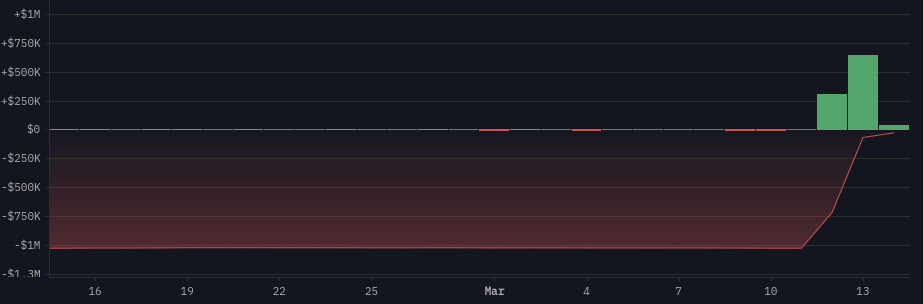

Last week, news of Circle’s $USDC reserves in collapsed Silicon Valley Bank caused investors to flee to safe havens.

However, some traders saw the $USDC depeg as a profitable opportunity.

Here are some of the large wallets that profited from betting heavily on $USDC:

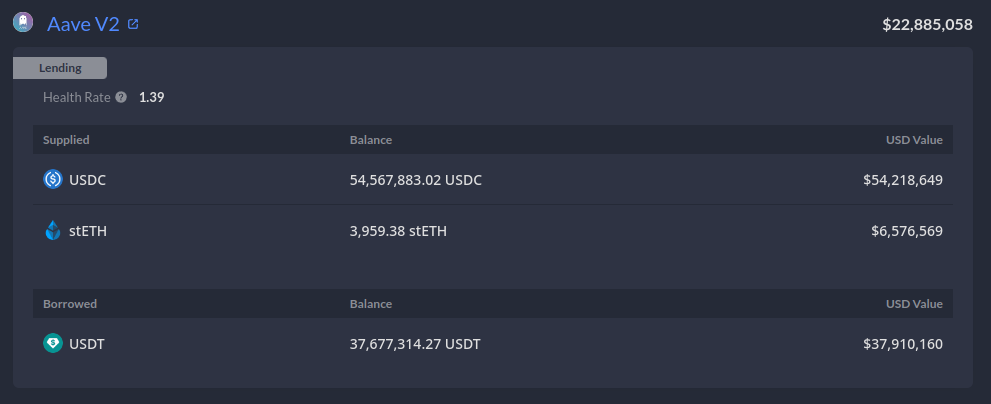

Generally, all wallets on the list have in some ways looped through the steps below to increase their borrowing size on Aave:

Deposit $USDC as collateral

Borrow $USDT

Swap $USDT for $USDC

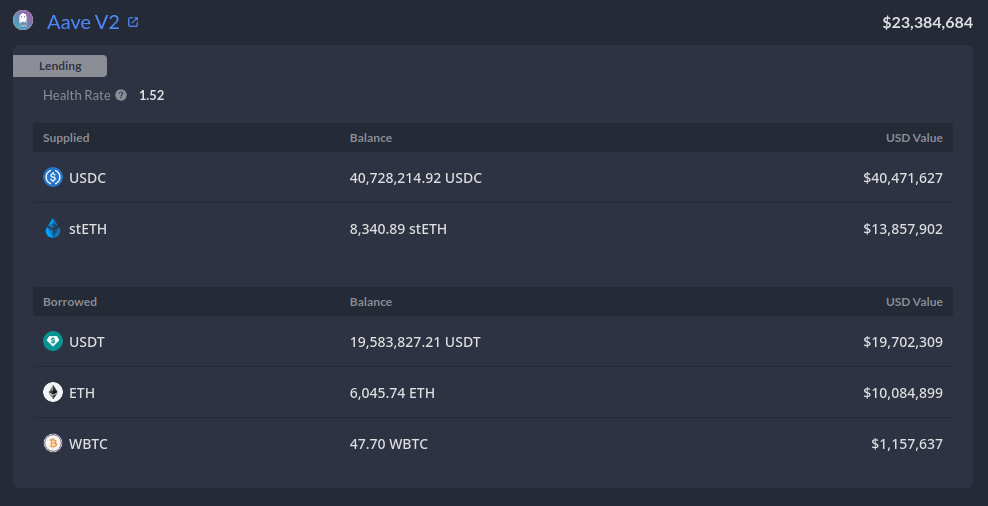

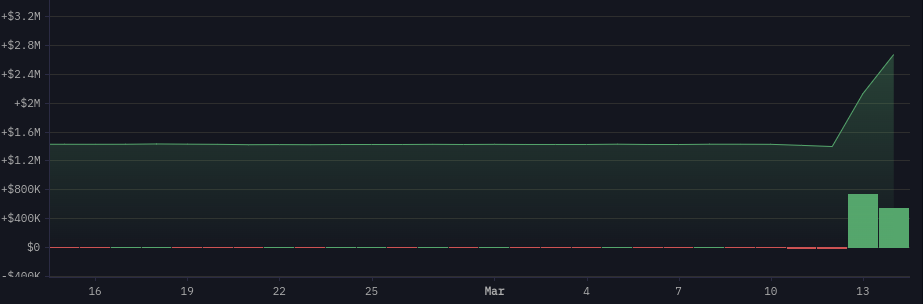

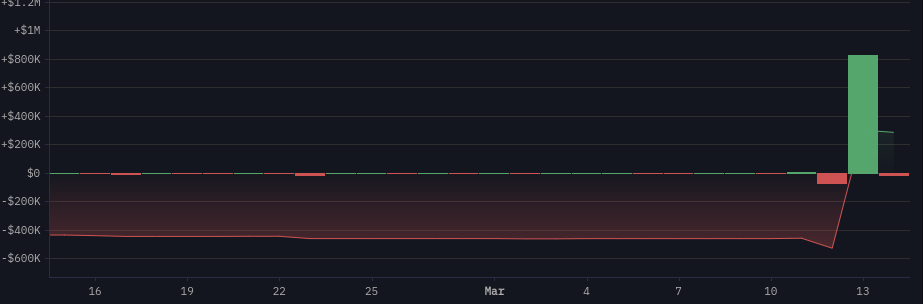

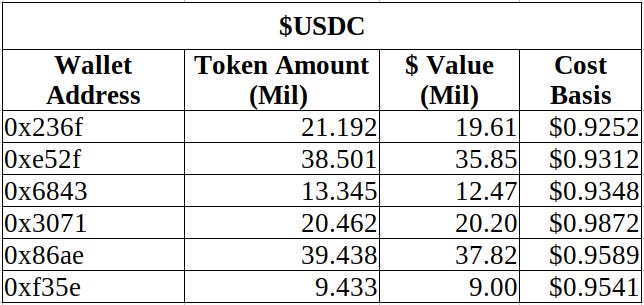

0x236f

This wallet accumulated $USDC at the lowest price.

The user executed a series of $USDT borrows from Aave, totaling about $19.5M which was used entirely to swap for $USDC. These swaps averaged $0.9252 per $USDC.

At time of writing, the stablecoin loans are yet to be unwound.

0xe52f

Saw an inflow of 5.26M $USDC from CEX (mainly Bybit).

The user borrowed $USDT in the same loop as above, swapping a total of 30.9M $USDT for $USDC to be used as collateral.

Assuming the initial $USDC from CEX was purchased at time of inflow, the cost basis for 0xe52f5 across all platforms averaged at $0.9312 per $USDC.

0x6843

Had periods of flipping between $USDC and $DAI as the preferred choice of collateral but nonetheless, the pattern of borrowing $USDT to be swapped for more $USDC/$DAI still holds true.

In total, 12.48M $USDT was swapped for $USDC at a cost basis of $0.9348.

0x3071

This InstaDapp account started the borrowing loop an hour before Circle announced SVB as one of six banking partners holding reserve funds, and stopped an hour before Circle announced the amount of funds stuck on SVB.

The timing of the trades suggests this is an insider trade.

The user borrowed a total of 20.2M $USDT which was used entirely to swap for $USDC at an average price of $0.9872.

0x86ae

Executed a series of $USDT to $USDC swaps and only started the borrowing loop after FDIC’s decision to fully cover deposits.

The user borrowed a total of 37.8M $USDT, and averaged $0.9589 for $USDC swaps. The borrowing loop is still being executed at time of writing.

0xf35e

User only started the borrowing loop when $USDC showed signs of peg recovery. $USDC and $DAI was used as initial collateral, but subsequently only $USDC is involved in the borrowing loop.

User borrowed 9M $USDT in total, and averagely swapped for $USDC at $0.9541.

The summary of the wallets and their cost basis is shown below, with only a single wallet showing indications of being an insider.

These users were able to profit off the depeg as they believed in the fundamentals of $USDC, and that the depeg was just a temporary liquidity issue.