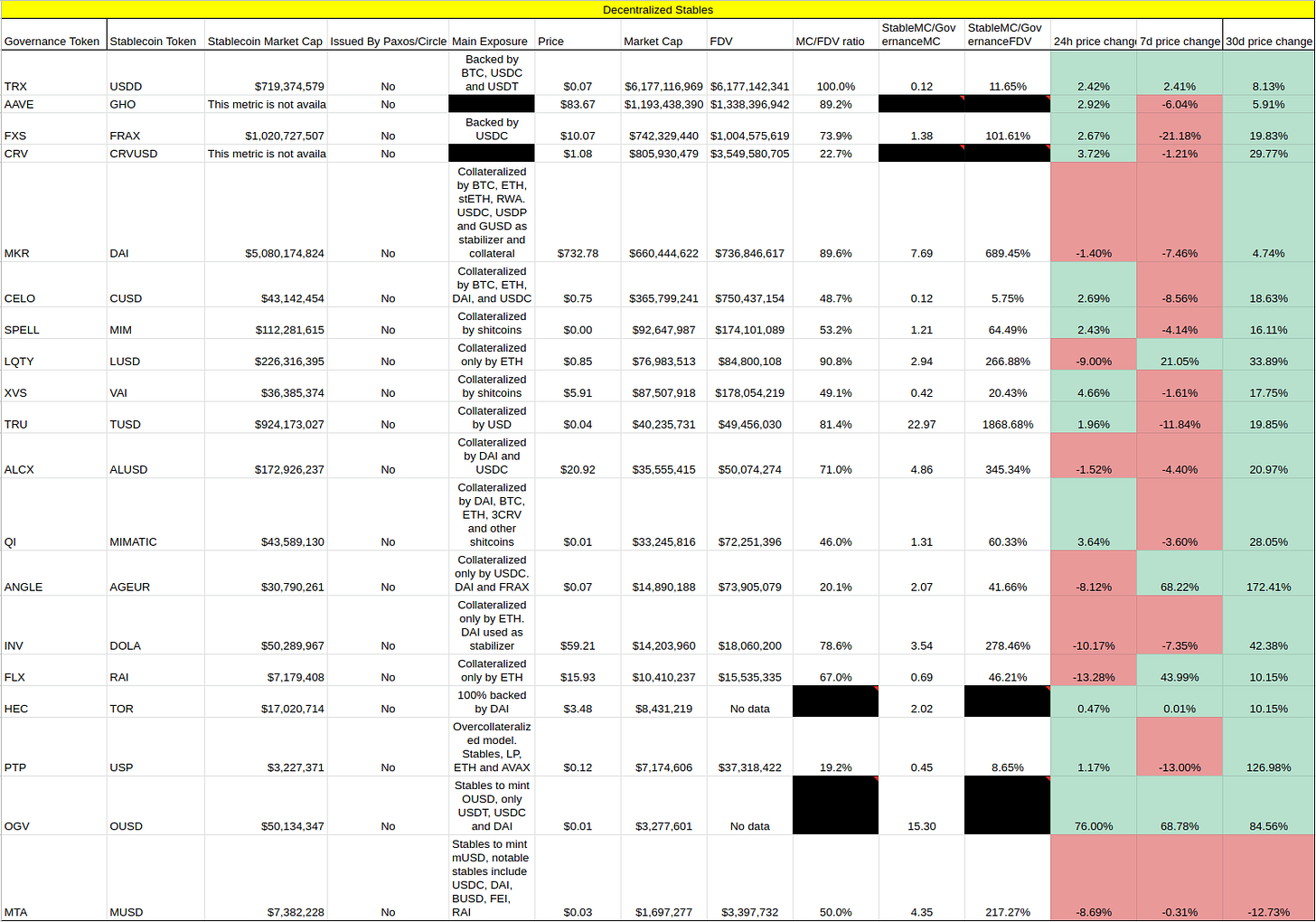

Overview of the Decentralized Stablecoin Landscape

The current state of decentralized stablecoins

Recent crackdown against centralized stablecoins and their possible classification as a security has put some spotlight on decentralized alternatives.

Here is what you need to know about the current decentralized stablecoin landscape.

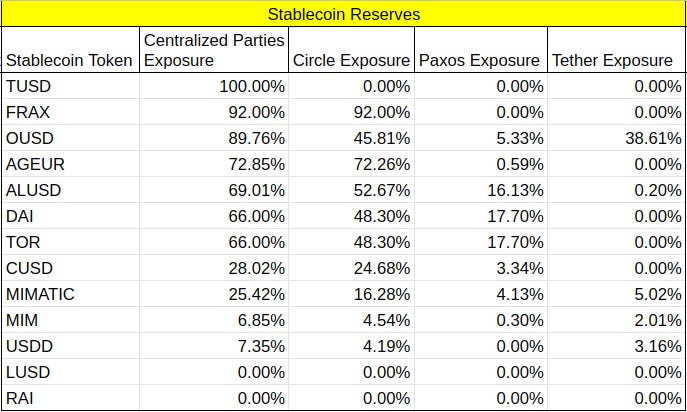

A good metric to evaluate a stablecoin’s resilience is their exposure to centralized parties, with the largest ones being Circle, Tether and Paxos. From this perspective, we can attempt to assess which ones can withstand regulatory crackdowns and become more likely to get be adopted as the “pure” decentralized alternative.

Currently, stablecoins in precarious positions are $DAI and $FRAX from the perspective of centralization risk, market caps, and importance in the DeFi ecosystem. $FRAX has 92% exposure to Circle, while $DAI has 66% exposure to Circle and Paxos. While it is unlikely that either stablecoin will face significant issues in the short term, their high levels of centralization and dependence on single collateral types may pose long-term risks for their viability and resilience.

The Maker team has made efforts to decentralize their reserves further by diversifying collateral beyond $USDC. However, current numbers are still concerning if Circle and Paxos were to face decisive regulatory actions. In the past, there were discussions about using their entire $USDC balance to buy $ETH as part of a decentralization effort, but the community did not agree with this approach.

Eventually, Maker's Endplan, which was drafted by its co-founder RUNE to decentralize $DAI, involves increasing the $ETH reserves, limiting RWA exposure, and reducing Maker's governance complexity through the creation of MetaDAOs.

On a recent podcast, Sam Kazemian acknowledged the considerable custodian risk and said that there are plans to collateralize $FRAX more directly with fiat through a Federal Reserve Master Account. While a good strategy, it will still take a long time to happen and in the meantime the current regulatory risks still apply.

Inversely, $RAI and $LUSD are the most decentralized stablecoins, with no custodian risk and being fully backed by Ethereum.

Key points on the top decentralized stablecoins

$MKR / $DAI

$DAI’s centralized collateral exposure is high

48% of $DAI is minted through the $USDC PSM

If Circle comes under SEC scrutiny, Maker's plan to reduce its reliance on $USDC through co-founder Rune's proposal may be hampered as it has faced community resistance

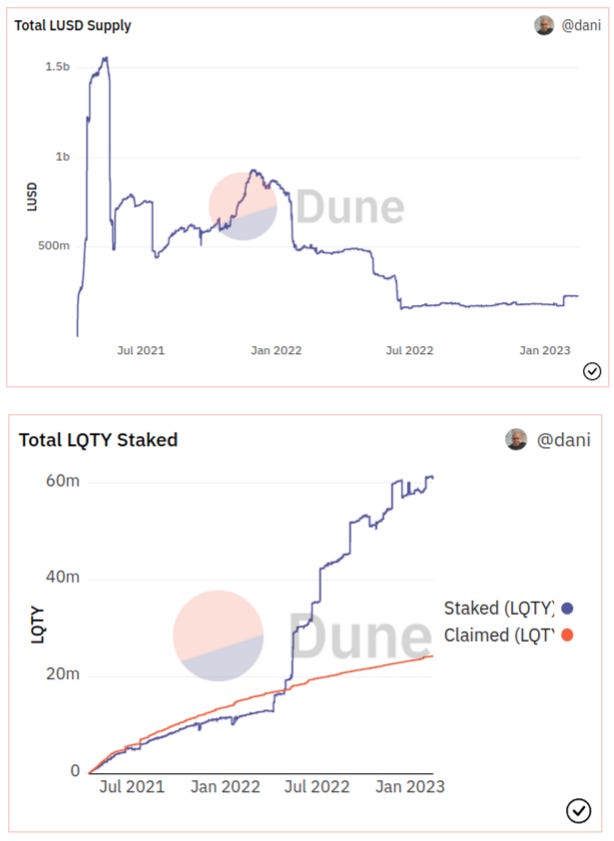

$LQTY / $LUSD

Unique proposition (non-USD stablecoin)

Fully backed by $ETH, no custodian risk

Slow & steady, Liquity continues work on bringing $LUSD liquidity cross chain with their X-Chain Strategy

Notable stats from Dune:

32.9% increase in $LUSD supply in late January after six months of being flat

Total Staked $LQTY constantly outpaces claimed (emission) $LQTY

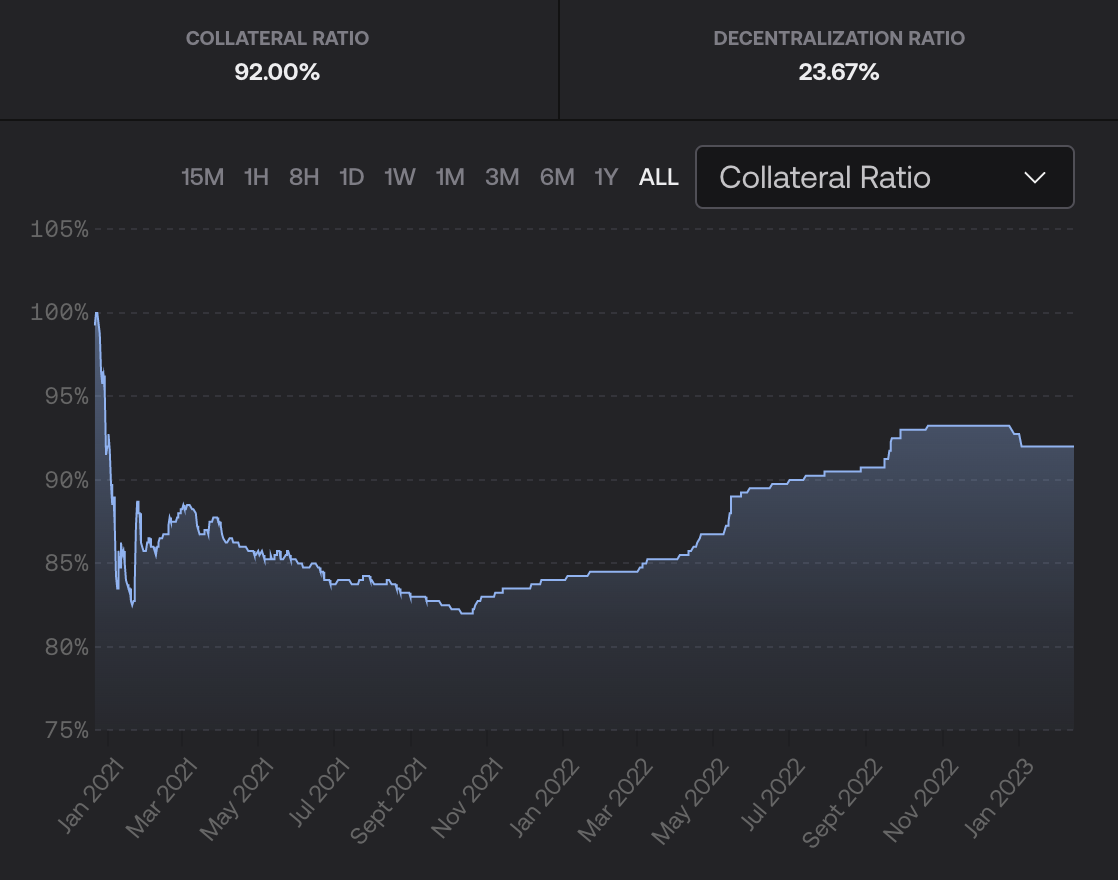

$FXS / $FRAX

$FRAX’s centralized collateral exposure is extremely high

Plans to increase direct fiat collateralization through a Federal Reserve Master Account

Backed by both $USDC and its native token $FXS through the AMO smart contract

$FLX / $RAI

$RAI overview: A cool experiment

Vitalik's take on $RAI

Fully backed by $ETH, with no custodian risk

CZ has expressed interest in other non-USD stablecoins in the future

$RAI metrics are on a downtrend

$AAVE & $CRV / $GHO & $crvUSD

Stablecoin has not yet been released

Aave’s $GHO is live on testnet

$crvUSD is currently in development

$ANGLE / $agEUR

It is the largest and most liquid decentralized Euro stablecoin

They are also launching a stablecoin backed by gold soon

$TRX / $USDD

Overcollateralized algo-stable similar to Terra’s $USTC, backed by $TRX that is burnt to mint $USDD

Also has additional collateral assets - $BTC & $USDC

Collateral composition is reasonably decentralized but Justin Sun’s control over its issuance presents a different set of centralization risk

$ALCX / $alUSD

$alUSD’s centralized collateral exposure is high.

Only stablecoin deposits can borrow $alUSD, $ETH deposits do not back $alUSD

Zero liquidation loans

$SPELL / $MIM

Vaults are collateralized by yield-bearing tokens to mint $MIM

Terra death spiral caused $UST vaults to accrue bad debt

Failed to gain usage traction since the $UST depeg