Comparative Analysis of $SUDO vs $BLUR

Recently, a governance proposal to make $SUDO transferable was passed, causing a surge in its value and $XMON. This follows the anticipated launch of $BLUR, generating significant interest on these tailwinds.

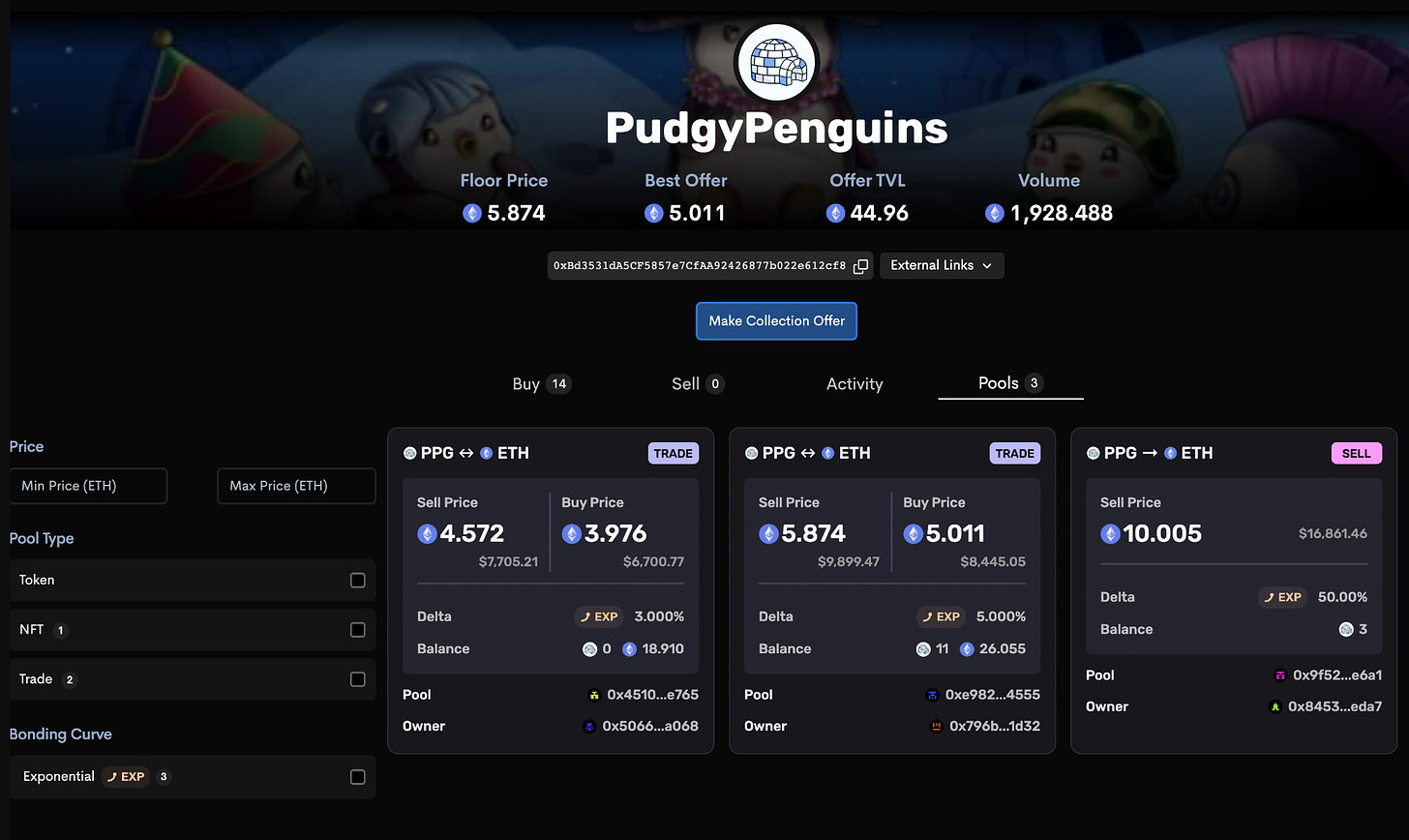

$SUDO is Sudoswap's governance token, an AMM protocol for NFTs with customizable bonding curves. During the lockdrop period lasting until March 1st, users can lock $XMON and receive $SUDO at a 10000:1 ratio. After this period ends, $XMON can no longer be exchanged for $SUDO.

When $SUDO became tradable, a huge influx of $XMON buys occurred. Individuals bought and locked $XMON to receive $SUDO instantly, causing $XMON's price to double shortly after. With the shift towards $SUDO as the sole governance token for Sudoswap, the value proposition of $XMON will primarily be as an NFT collectible. Unless there is a new utility planned for $XMON, its value will likely drop sharply immediately after the lockdrop ends.

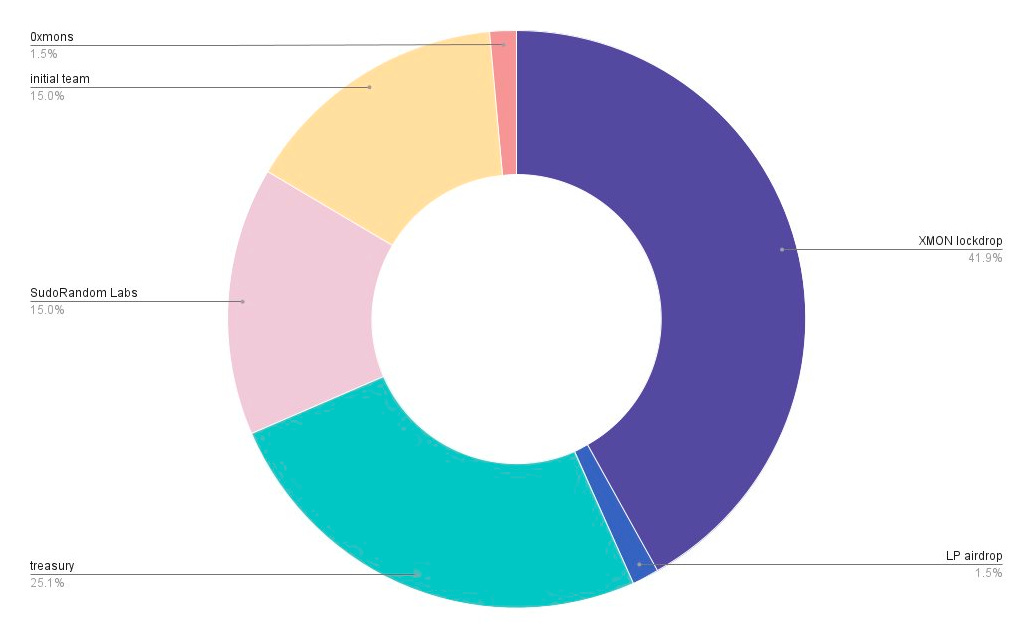

To evaluate $SUDO's financials, we need to examine its tokenomics:

The team owns 30%, which will be unlocked in one year, followed by a 4-year vesting period

25.1% goes toward the treasury

3% is airdropped to 0xmons NFT holders and past LPs

41.9% goes to the $XMON lockdrop

$SUDO is fully community-owned, with the majority of the supply held by $XMON holders and team members without VC involvement. Since team members’ tokens are locked for a year, nearly all of the current circulating supply of SUDO is held by $XMON holders.

On-chain data also reveals that 80% of $XMON’s circulating supply is in the lockdrop contract, indicating high demand for $SUDO exposure among current holders. However, the team's plans for the remaining 7488 tokens in the dev multisig wallet are still unclear. This means that 36.5% of $SUDO's total supply is currently in circulation, held mainly by $XMON holders. If they choose to lock all of their tokens, $SUDO's circulating supply could get as high as 44.9% by the end of the lockdrop

On February 20th a governance proposal was put forth by @TaikiMaeda2 to burn unclaimed $SUDO tokens from Lockdrop & Airdrop. If the proposal passes and considering there are no significant changes to the current amount of XMON tokens in the Lockdrop contract, an 8% $SUDO supply burn will occur as a result.

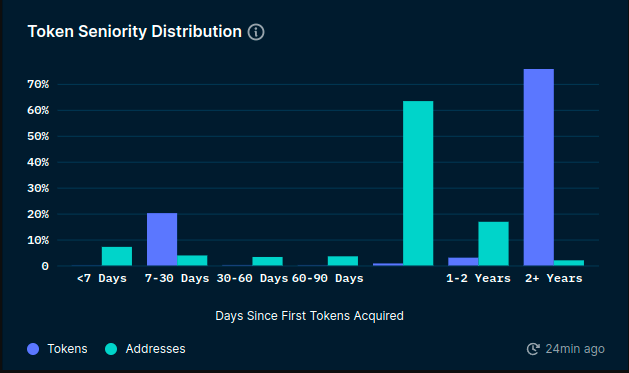

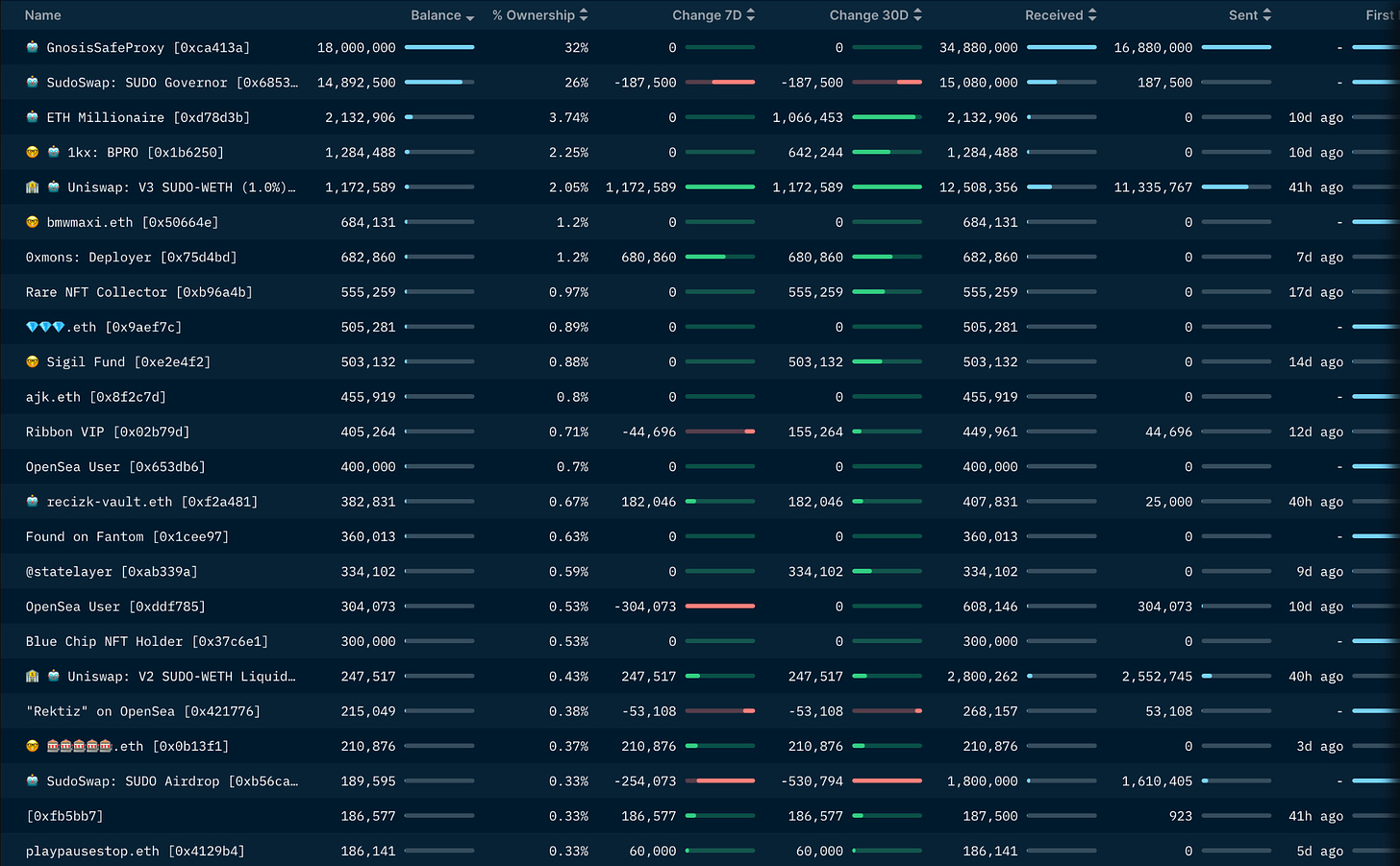

Given that $XMON holders have demonstrated strong holding tendencies historically, and they hold the majority of $SUDO's supply, it is important to monitor the largest holders for any potential deviation from this behavior.

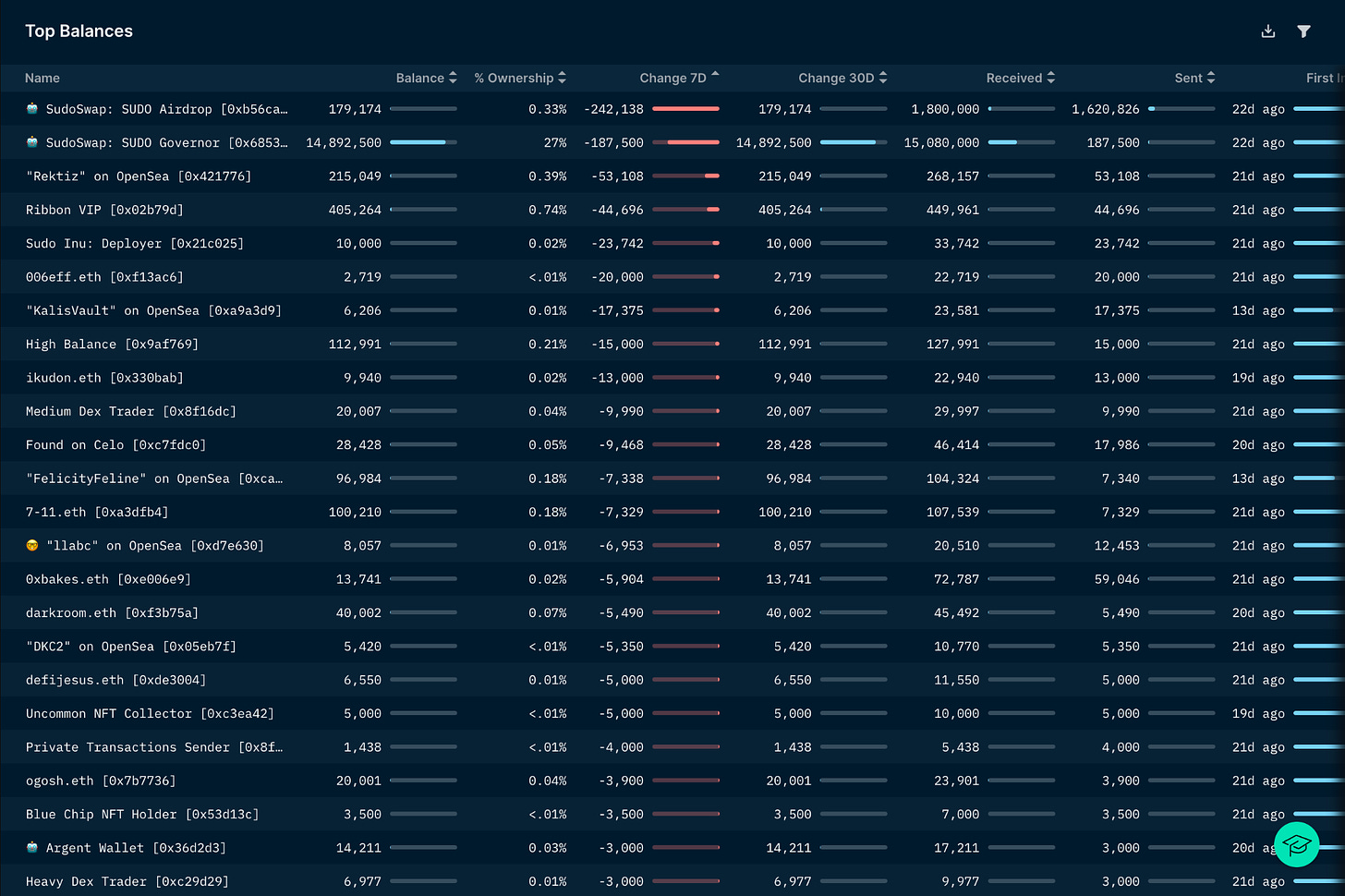

Notably, some individual public wallets own most of the circulating supply, and a potential sell-off from these addresses could strongly impact $SUDO's price in the short term. However, the largest sales have come from small traders, and large outflows were mainly related to liquidity provisioning.

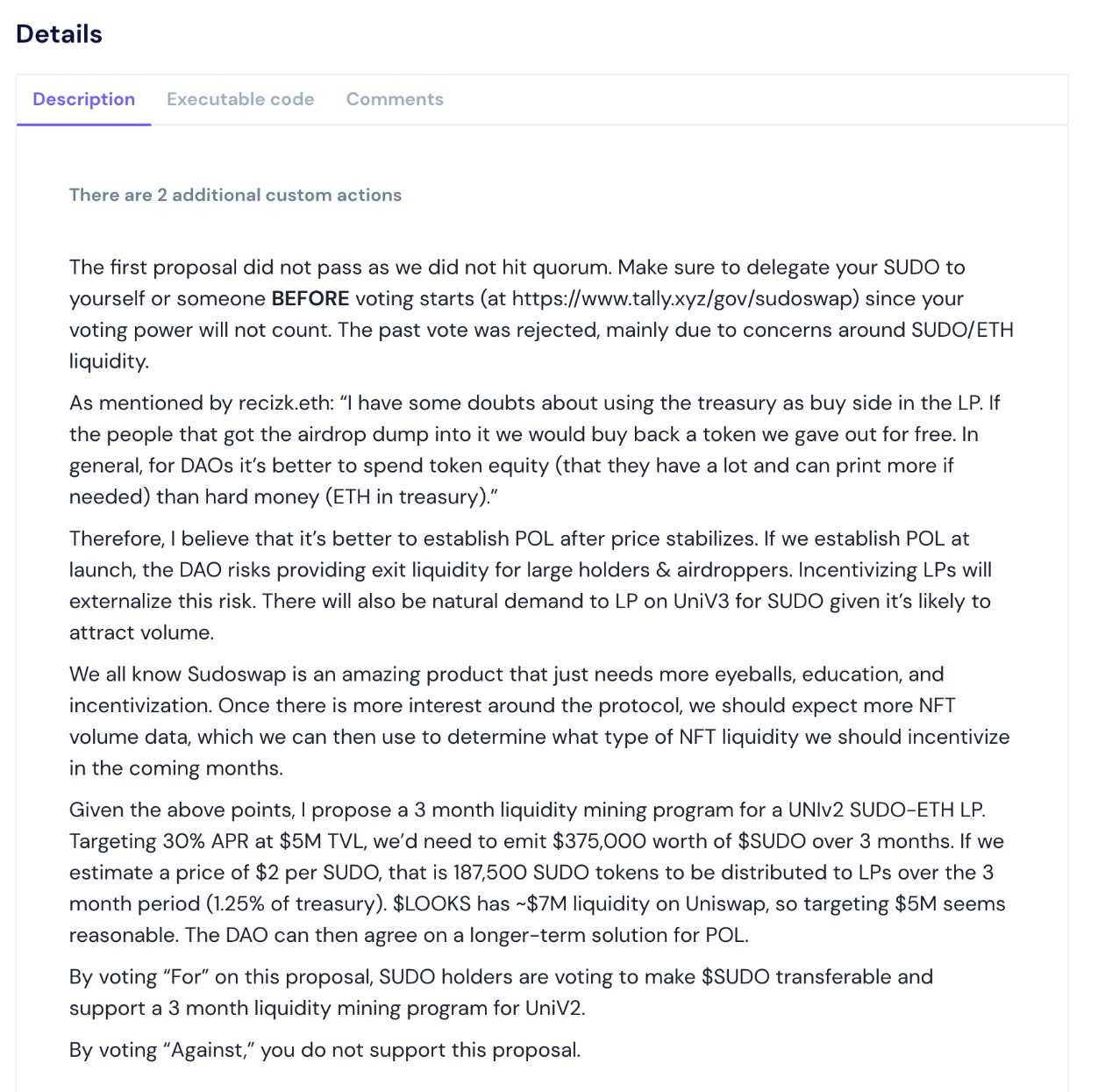

With the transferability proposal passed, the liquidity mining program was also set live, with a distribution of 187,500 tokens over a 3-month period, which represents 1.25% of the treasury.

Still, the staking UI is not live yet, and users must stake their LP tokens directly through the contract. Once the UI is live, it is expected that the majority of the LPs will join the program to take advantage of the attractive farming rewards, which can reach up to 30% APR

The current liquidty pool has a TVL of $5M; however a closer analysis of the on-chain liquidity shows it is heavily skewed towards the sell side, concentrated in a range that is considerably higher than the current prices.

With this in mind, we've gathered some interesting findings of some the largest holders:

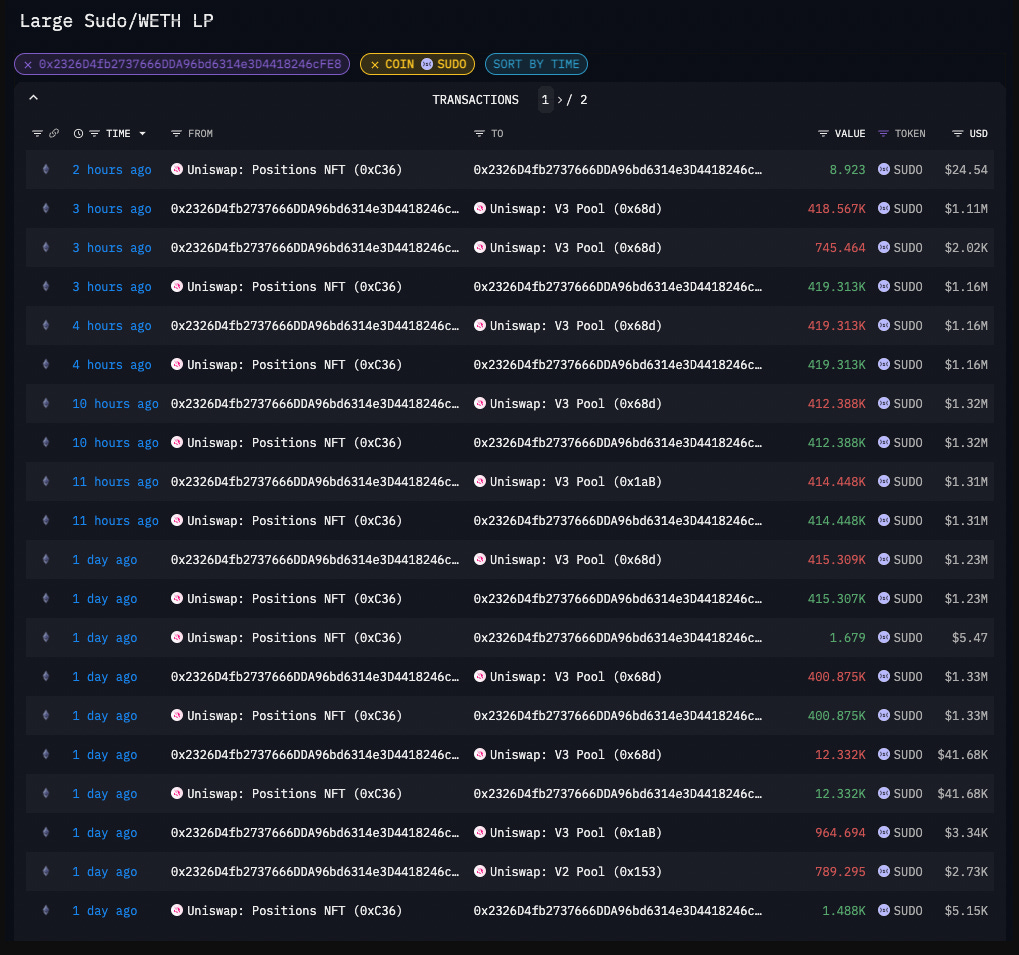

This wallet, 0x2326D4fb2737666DDA96bd6314e3D4418246cFE8, received $1.37M worth of $SUDO and has LP’ed almost all of it in the past 30 hours.

Recently, 0xF2a4814814DA725CDB44632D0724A16461A51578, a multisig wallet controlled by recizk.eth, has sold $500k worth of $BLUR for $SUDO at an average cost of $3.4 per $SUDO. However, it is now down 25% on its initial purchase.

A few hours ago, he had also invested $500k in $BLUR, which suggests he is bullish on the NFT narrative and is betting on the success of both the Blur and Sudoswap marketplaces.

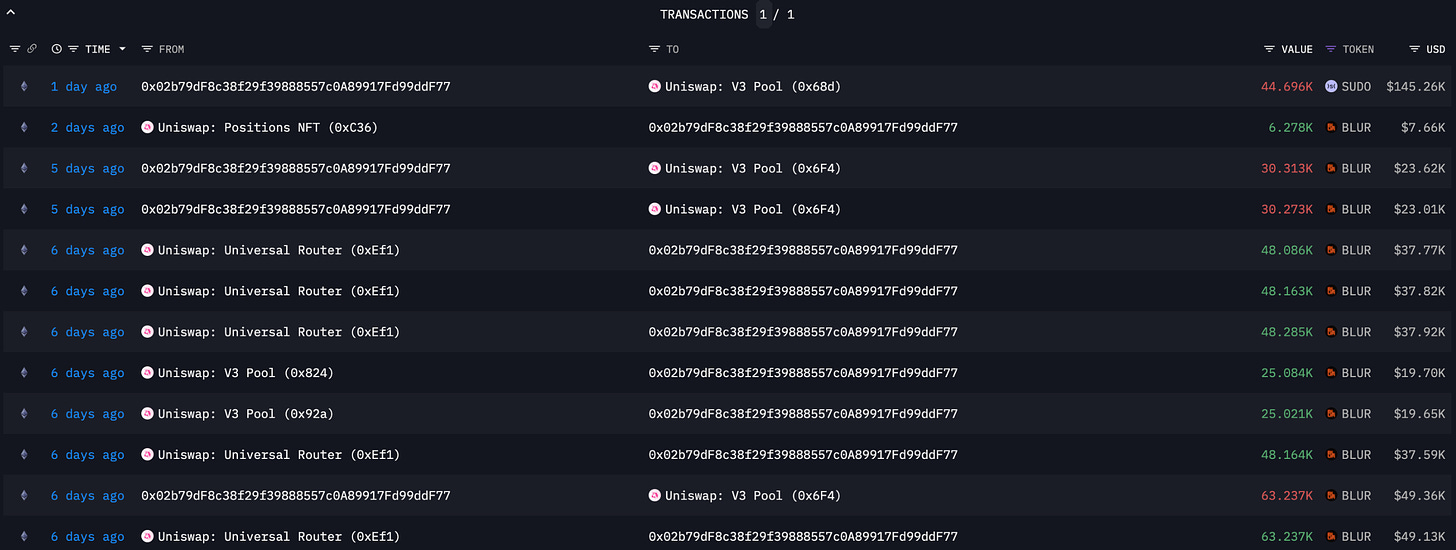

0x02b79dF8c38f29f39888557c0A89917Fd99ddF77, the 12th largest holder of $SUDO has been gradually LPing with 10% of his holdings so far, and has yet to sell any tokens. He is also recently invested $237k in $BLUR at an average cost is $0.77, being up 60% on his initial investment.

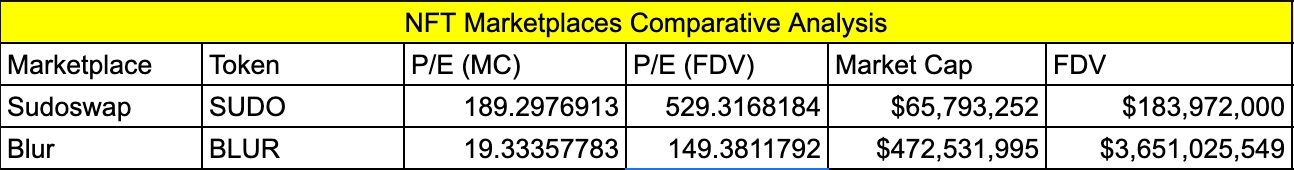

Considering 80% of $XMON holders have participated in the lockdrop program, the implied circulating market cap of $SUDO is $65M, which is 7 times lower than $BLUR's. To further compare both marketplaces, it is also important to consider their historical user activity and annual revenue.

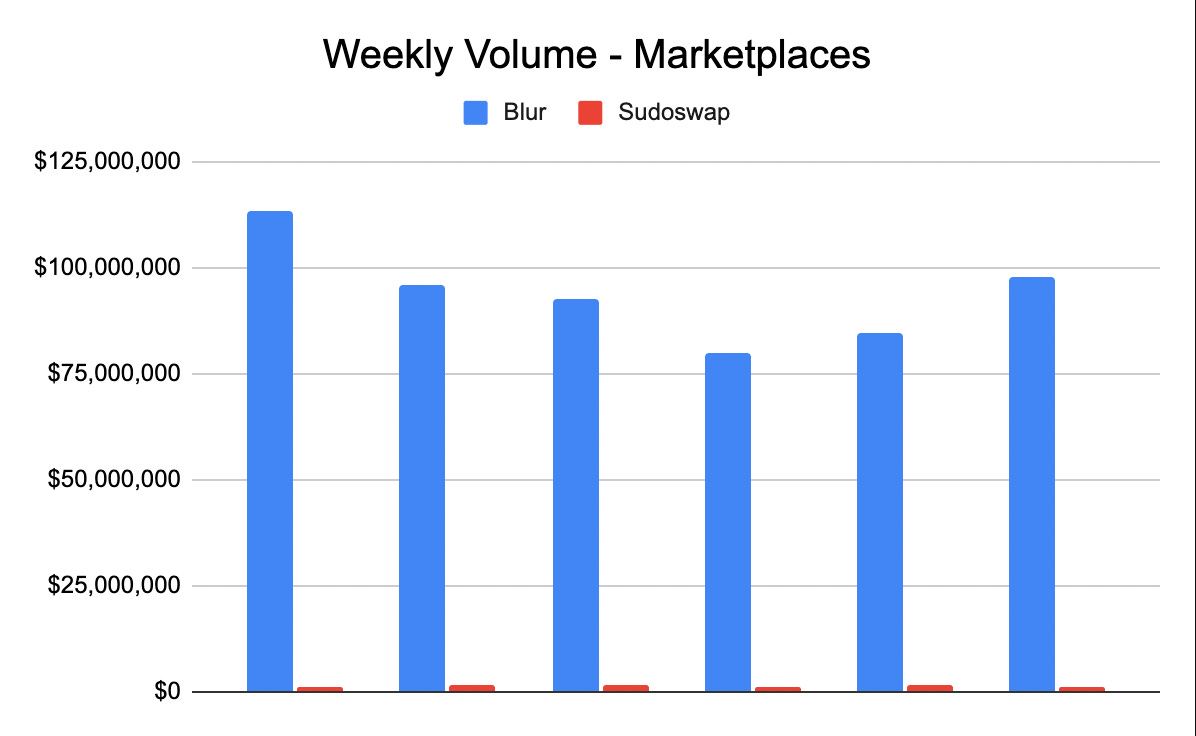

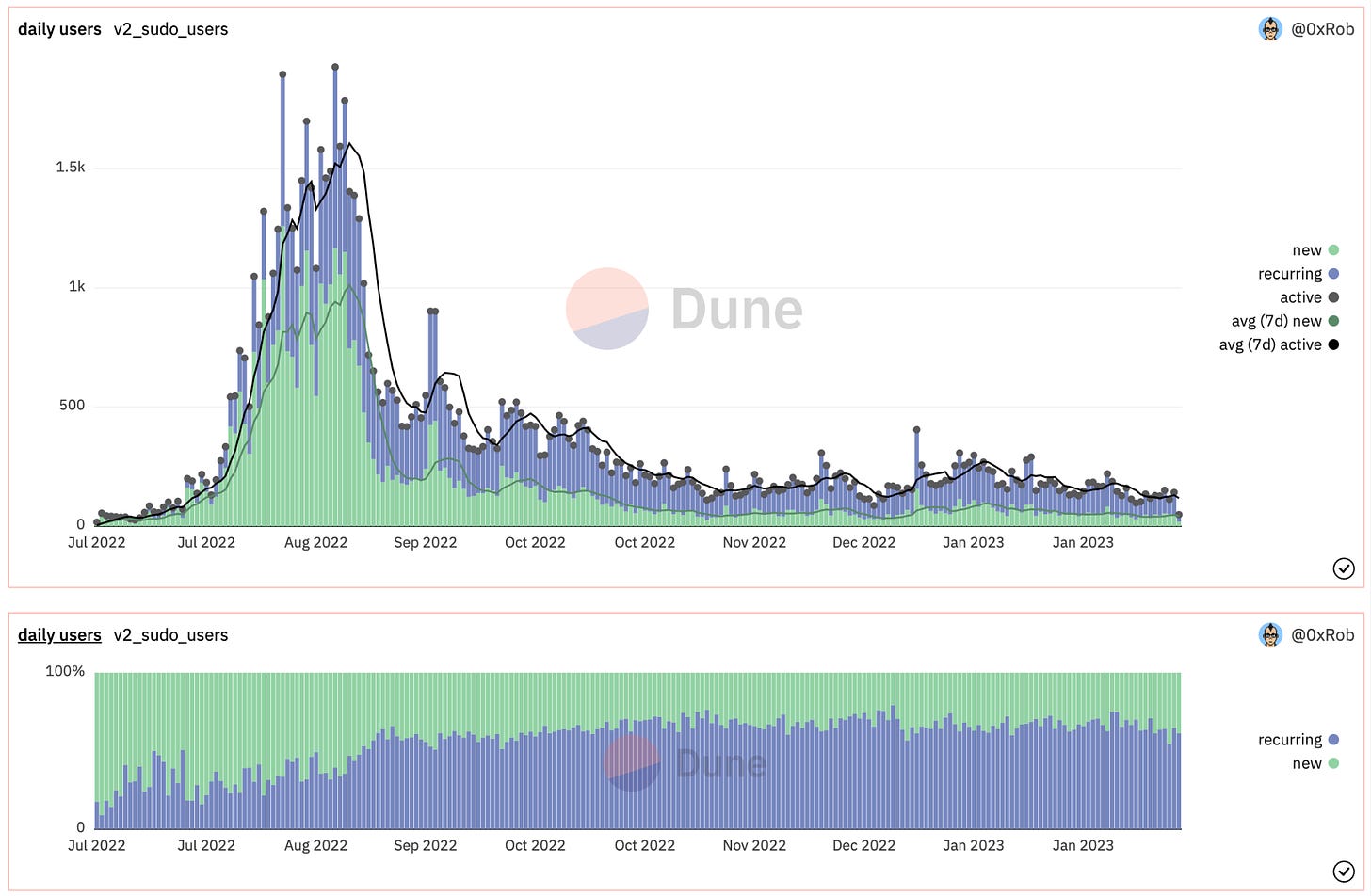

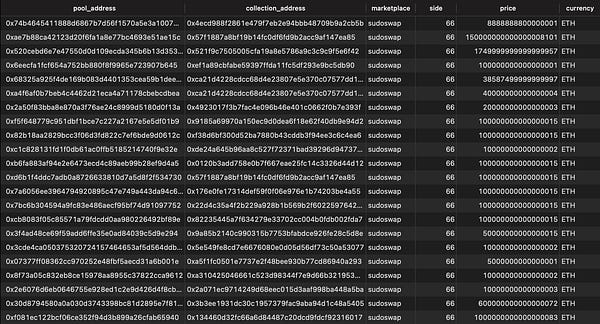

On-chain data indicates that Blur has had significant user activity in the past weeks with $564M YTD in trading volume and $2.8M in revenue, while Sudoswap's overall activity has been underwhelming with decisively lower volume at $8M YTD and $40k in revenue.

The 189 P/E ratio of $SUDO compared to $BLUR's 19 may make $SUDO appear expensive, particularly given its low user activity and revenue generation. However, these numbers do not tell the whole story.

While $BLUR has stronger user activity and revenue numbers, it is important to consider the differences in their incentivization models. Most of $BLUR's activity is incentivized, while $SUDO's is organic and the marketplace is entirely community-owned.

Additionally, Sudoswap's unique tech and use case is yet to be fully explored, which may offer significant room for growth in the future, especially with Uniswap's rumored upcoming integration.

From a decentralization perspective, Blur relies on their own servers for execution, whereas SudoAMM does it fully on-chain, with no involvement from centralized parties. In a period where regulatory crackdown is a growing concern, this is an important point worth considering.

It is also worth mentioning that when compared to Blur, Sudoswap has a steeper learning curve as users are required to have a better grasp of technical concepts to use the platform effectively.

Both platforms have their unique strengths and weaknesses, and their success going forward will depend on various other factors such as community support, adoption, and innovation.